Introduction

A brief description of RAK Ceramics Bangladesh Ltd.

Name of the company

|

:RAK

Ceramics Bangladesh Ltd.

|

Date

of incorporation

|

: November 26, 1998

|

Commencement of Business

|

: 12 November 2000

|

Authorized Capital

Pre- IPO paid-up Capital

IPO size

|

: Tk.3,000 mn

: Tk. 1,855.64 million

: Tk. 300 million.

|

Face

Value

Indicative

price

Nature

of Business

|

: Tk.

10

: Tk.

40

: The Company is engaged in manufacture and

sell of tiles and sanitary

ware.

|

Turn Over (sales)

Profit after tax

EPS (Basic)

|

:Tk.3,247.99mn for year ended on the 31.12.08. and Tk.1910.35 for

last 6 (six ) month as on 30.06.09.

: Tk. 286.4 mn for the

year ended on 31.12.08. and Tk.142.46 for last 6 (six ) month as on 30.06.09

:Tk. 10.99

|

Short term and long term loan from different Banks

Investment in Subsidiary Companies

Share Money deposit

|

: Tk. 1220.45 mn.

: Tk. 362.66 mn

: Tk.558.84 mn

|

Major Product

Issue Manager

Auditors

|

: Tiles and sanitary ware

: IDLC Finance Ltd

& Equity Partners Ltd.

|

RAK Ceramics (Bangladesh) Limited, a

UAE-Bangladesh joint venture company, was incorporated in Bangladesh on 26

November, 1998 as a private company limited by shares under the Companies Act

1994. The name of the Company was thereafter changed to its name from RAK

Ceramics (Bangladesh) Private Limited to RAK Ceramics (Bangladesh) Limited on

10 June 2008, certificate issued by the Registrar of Joint Stock Companies

dated 11 February, 2009.

It is engaged in manufacturing and

marketing of ceramics tiles, bathroom sets and all types of sanitary ware. It

has started its commercial production on 12 November 2000. The commercial

production of new sanitary ware plant was started on 10 January 2004. Further

expansion of the existing facilities of ceramics tiles plant took place in year

2004, and for tiles and sanitary plants were in year 2007.

RAK

Ceramics (Bangladesh) Limited, 90% held by RAK Ceramics PSC, a company incorporated

under the laws of UAE and remaining 10% owned by local investor Mr. S.A.K.

Ekramuzzaman.With an annual turnover of over BDT 3248 million, within the short

span of eight years RAK has firmly established itself as one of the leading

manufacturer of high quality ceramic wall, floor tiles, gresporcellanato and

sanitary wares products in Bangladesh.

Specializing in high-quality ceramic

wall and floor tiles, GresPorcellanato, and sanitary ware, RAK Ceramics uses

more than 8,000 production models, with new designs added almost every week to

its portfolio. Tiles are manufactured in a variety of sizes.

RAK

Ceramics is the world’s first company to launch Luminous, the wonder tile that

glows in the dark and the Antimicrobial, a super specialty tile for the

hospitality industry. The company's creations include the high-valued brand

"Elegance Ceramics" and it continues to be a global pioneer in the

world of ceramics through innovative eco-friendly products such as RAK SLIM,

Stone Art Collection, Orion Collection and Wood Art Collection using the latest

Nanopix digital printing technology. It has also launched its trendy tiles in

unique sizes of 25x70 and 20x50 appealing to the urban consumers. Further it

has tapped children tiles segment with the launch of Junior Tiles Collection.

The

global production of tiles exceeds 360,000 sq.m. and 12,000 pieces of sanitary

ware per day from its 10 state-of-the-art plants in UAE and 1 plant each in

China, Sudan, Bangladesh, India and Iran. RAK Ceramics manages around 8,000

employees in UAE and 12,000 employees worldwide and currently exports to more

than 160 countries, which is a testimony to its excellent reputation worldwide.

RAK Ceramics has recently achieved the status of supplying 1 billion sq.m. of

tiles and 50 million pieces of bathware worldwide and it is the fastest

ceramics manufacturer to achieve the milestone since its inception within two

decades.

RAK

Ceramics is a ISO 9001 : 2008 & ISO 14001 : 2004 certified organisation. In

2007, it was given an AA rating and was ranked among the top four brands in the

UAE by UK-based Brand Finance Middle East. RAK Ceramics was also recognised as

Company of the Year in 2004 by the Arabian Business Awards and bestowed the MRM

Business Award for Manufacturing, the highest manufacturing award of the UAE.

RAK

Ceramics was also honoured by the Emirates Securities and Commodities Authority

(ESCA) for complying with good governance and transparency according to best

international practices.RAK Ceramics won the Innovation Award for its

revolutionary RAK Slim tiles. RAK Ceramics was also honoured with the Best

Brand Award. It has achieved the Environmental Performance Certificate (EPC) in

recognition of its successful efforts to comply with environmental protection

standards and regulations. RAK Ceramics is the first ceramics manufacturing

company in the region to produce GRI-based sustainability report.

RAK

Ceramics offers a complete solution with its diversification into tile

adhesives and grouts in a joint-venture with Laticrete International Inc of USA

to form Laticrete RAK; a joint venture with German-based Kludi to manufacture a

range of taps, faucets and other accessories for sanitary-ware products under

the brand name Kludi RAK; eco-friendly paints under the brand RAK Paints and

RAK Porcelain, the tableware range of products targeted at high-end hospitality

industry. All these subsidiaries contribute to RAK Ceramics brand by offering

complete value-added service to clients.

The Products of RAK Ceramics company :

RAK Ceramics Ltd. Produces a wide range of products such as

Ceramic Wall and Floor Tiles, Decors and Boarders. It also produces an

extremely wide range of products in GresPorcellanato in several finishes suited

for any ambience.

The products of RAK Ceramics company are given below :

Wall tiles

|

Floor tiles

|

Sanitary ware

|

Ceramics

|

Ceramic-GresPorcellanato

|

Model wise

bathrooms set

|

Décor tiles

|

Salt and

Paper(Glaze)

|

Over counters

|

Border tiles

|

Salt and

Paper(Homogeneous)

|

Under counters

|

Wall tiles

matching with Decors and Borders

|

Soluble

Salt(Mirror Polish)

|

Wall mounted wash

basins

|

Double

charge(Mirror Polish)

|

Other accessories

|

|

Wooden model

|

Asian water closet

|

|

Stair and pavement

|

Wash basin

pedestal

|

|

Slate and Rustic

|

Urinal Bow

|

Market Share and Dividend Policy of

RAK Ceramics Bangladesh Ltd :

Authorisedcapital

: 6,00,000,000 ordinary shares of Taka 10 (upto 2012)

Issued,

subscribed, called and paid up :

278,388,935

ordinary shares of Taka 10/- each.

Dividend

Policy :

The Board of Directors of the Company is pleased to recommend dividend

15 percent in cash and 10 percent in stock of the paid up capital of the

Company for the year 2012. Previous year dividend was paid at 15percent in cash

and 10 percent in stock. They

have adopted Dividend Discount Model (DDM) for valuing the share of RAK. The valuation is based on the forecasted

earnings and dividend payments of the

company prepared by RAK Ceramics (Bangladesh) Limited.

.

Marketing Mechanism and Distribution of the

Products :

RAK ceramics is currently leading the company

strategically to position rak ceramics as a premium international brand known

for its innovative product range through technological advancement and

high-quality production. RAK ceramics has invested heavily in research and

development as innovation is the key factor for the company’s sustainable

success as it continues to add new designs and models on a frequent basis to

cater to different markets. It has

sustainable growth plan. With its state-of-art plants and distribution network

and diversified range of products, rak ceramics will continue to exploit new

opportunities for growth and expansion. RAK ceramics offers a complete interior

solution with its diversification into tile adhesives and grouts in a joint-venture

with laticrete international inc of usa to form laticreterak; a joint venture

with german-based kludi to manufacture a range of taps, faucets and other

accessories for sanitary-ware products under the brand name kludirak;

eco-friendly paints under the brand rak paints and rak porcelain, the tableware

range of products targeted at high-end hospitality industry .RAK company always

try to go close to their clients by listening to their needs and adapting to

market requirements excellence in producing high-quality products that offers

best value-for-money redefining the product innovation and design process

accountable to its clients, trade partners, stakeholders and employees motivate

to develop them into future entrepreneurs, integrity of the management towards

the organisational goals committed to the society by contributing towards a

healthy environment.

INDUSTRY ANALYSIS

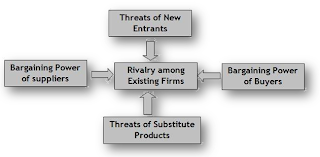

Porter’s

five forces model identifies the following factors which affects an Industry’s external environment.

Figure :

Porter’s five forces model

Understanding

these competitive forces and their underlying causes reveals the roots of an industry’s

current profitability while providing a framework for anticipating and

influencing competition (and profitability) over time (Porter 2008). Porter

argues that the stronger each of these forces is,the more limited is the

ability of established companies to raise prices and earn greater return.

Within Porter’s framework, a strong competitive force can be regarded as a

threat since it depresses profits. A weak competitive force can be viewed asan

opportunity, for it allows company to earn greater profits. The strength of

these five forces may change through time as industry conditions change profits

.The analysis of five forces indicates

that the collective impact of the competitive forces is moderate to weak;

hence, the ceramic industry of Bangladesh is considered to be competitively

attractive in the sense that industry members can reasonably expect to earn

decent profits and a nice return on investment.

Risk

of Entry by Potential Competitors

Normally companies

that are not currently competing in an industry, but have the capability of

doing so are known as potential competitors. Bangladesh has certain competitive

advantages in the international market in terms of availability of gas, cheap

labor and the generalized system of preferences (GSP) that allows Bangladesh to

have duty-free exports to Europe and there is no quota restriction either on

the export. Considering this sector’s potentiality for investment, ceramic

industry has always allured both local and foreign investors. Since domestic

and export demand for ceramic products are rising rapidly, widening the gap

between demand and supply, the new entrants can easily expect to earn

attractive profit by capturing the untapped demand. As the construction

industry including residences, shopping malls and others is growing so fast,

the ceramic tiles business is becoming one of the booming and prospective sectors.

In this sector, there are low entry barriers as the government regulations are

supportive for new entrants. However, the number of new entrants and their

capacity development is low compared to the growth in domestic and export

demand. Hence, the competitive threat of potential entry is not strong enough

to place significant competitive pressure on RAK Ceramics Bangladesh Ltd.

Bargaining

Power of Buyers

RAK Ceramics Bangladesh Ltd has got different types of

customers. They are both domestic customers and foreigncustomers. The individual

buyers mostly pay the seller’s posted price. However, itis relatively easy for

buyers to switch to comparatively low-priced imported ceramic goods; keeping

this in mind, the RAK Ceramics industry is aiming for competitive pricing to

attract and retain customers. As a result it has low bargaining power in local

industry. The bargaining power of international buyers is reasonably strong

enough to negotiate for price concession and favorable terms. But due to

increased production cost, other low price supplier countries are also failing

to offer competitive prices and losing their share in the international market.

Thus, more international buyers are moving towards Bangladesh as it has cost

competitiveness in terms of gas supply, cheap labor cost, skilled labor and

also has competitive advantage of possessing “bone china” technology. As the

number of buyers, both in local and international market, is growing, the

bargaining power of buyers is weakening for RAK Ceramics industry.

Threat of Substitute Products

The RAK ceramic

industry is already in fierce competition with low-priced sanitary ware, tiles

and table wares, mostly imported from China. Besides, it is also facing strong

competitive pressure from firms in other industries offering substitute products

such as low priced melamine wares, aluminum wares, steel kitchen wares, glass

wares and plastic wares etc. In recent years, large scale manufacturers have

entered the crockery market, with their brands competing strongly with both

local ceramics products and foreign products of their same kind. Companies like

Bangladesh Melamine, Sharif Melamine, RFL, BRB, and GAZI are contributing

greatly to this thriving crockery market by creating demand for new products.

Other substitutes of tiles include wooden flooring or tiles, bamboo flooring,

ply board, marble stones and other artificial stones for both interior and

exterior usage. Hence, the availability and low cost ofsubstitutes is exerting

moderately competitive pressure on RAK Ceramics Bangladesh Ltd.

The

Bargaining Power of Suppliers

Normally

suppliers become powerful over an organization when any of the following

situations prevails:

- Product that the supplier sells has few substitutes and is important to the company.

- When the company’s industry is not an important customer to the supplier.

- When suppliers respective products are differentiated to such an extent that it is costly for a company to switch from one supplier to another.

- When to rise prices, suppliers uses the threat of integrating vertically forward into the industry and competing directly with the company.

- When buying companies cannot use the treat of vertically integrating backward and supplying their own needs as a means of reducing input prices.

In

Bangladesh, there is a shortage of raw materials, equipment and machineries for

ceramic industry, it gives the supplier of RAK Ceramics Bangladesh Ltd more

leverage in bargaining the price. But the supplier base is moderately large

enough to weaken the supplier power.

Rivalry

among Existing Firms

The RAK Ceramics

Bangladesh Ltd faces stiff competition. Ceramic manufacturers like Monno

Ceramic, ShienpukurCeramic, Standard Ceramic, FARR Ceramic and Bengal Fine ceramics

are still leading in ceramics industries. All other ceramic manufacturers are

also increasing their production capacity following robust growth in demand for

ceramic ware. However, increment in the number of new plants, capacity

development, product development and market expansion by RAK Ceramic Bangladesh

Ltd made it reducing rivalry among existing firms. As there still exit ample

growth opportunities in this industry, the rivalry among the existing companies

are still weak.

Internal

Environment Analysis

The

RAK Ceramics Bangladesh Ltd’s profit is not stable over last several years. In

this section, attempts will be made to identify the causes and the sources of competitive

advantages of RAK Ceramic company.

RESULTS OF

INDUSTRY ENVIRONMENT ANALYSIS

Understanding

industry structure for RAK Ceramics Bangladesh Ltd is of great concern to

strategist since defending against the competitive forces and shaping them in a

company’s favor are crucial to strategy. Besides, it is also essential for

effective strategic positioning of a company. This analysis will help RAK

Ceramics Bangladesh Ltd. to decide how to influence or to exploit particular characteristics

of the ceramic industry. The analysis of porter’s five forces model indicates

that the industry environment of ceramic sector is weak to moderate competitive

and offers ample growth opportunities for both its incumbents and new entrants.

As the collective impact of the five competitive forces is moderate to weak,

the ceramic industry is considered to be competitively attractive in the sense

that industry members can reasonably expect to earn decent profits and a nice

return on investment. Therefore, to sustain in this industry, the RAK ceramics companies

should match strategy to prevailing competitive conditions of the marketplace.

These strategies should include actions such as continuous productdevelopment,

quality improvement and offering ranges of prices to satisfy allsegments of the

domestic and export market.

Identification of Red Flags & Estimating Earnings

Quality

|

Potential Red Flags Identification:

A very common approach to accounting

quality analysis is to look for “ red flags” pointing to questionable

accounting quality. These indicators

suggests that the analyst should examine items more closely or gather information

on them.

Some common types of red flags are:

1)Unexplained changes in accounting

especially when performance is poor.

2) Unexplained transactions that

boost up profits.

3) Unusual increase in accounting

receivable in relation to increase in sales.

4) Unusual increase in inventories in

relation to sales increase.

5) An increasing gap between a

firm’s reported income and its cash flow

from operating activities.

6)

An increasing gap between a firm’s reported income and its tax income.

7) A tendency to use financing mechanism like research and development

partnership and the sale of receivables

with recourse .

8) Unexpected large assets write

off.

9) Large fourth quarter adjustments.

10) Qualified audit opinions or

changes in accounting auditors that are not well justified.

11) Related party transactions or

transactions between related parties.

Identified Red

Flags of RAK CeramicsBangladesh Limited

:

I became able to identify the following two red flag of RAK Ceramics

Bangladesh Limited and gathered information about their origination-

1)

An

unusual increase is accounts receivables in relation to increase in sales is

traced in the year of 2010.

From the above table we can see that sales increased by only 14.25% in

the year 2011 but accounts receivables increased by 35% in that year. This may

be due to the fact that export sales decreased significantly at that year and

to cover up such decrease the company tried to increase local sales by

increasing credit sales.

I)

Significant

inecrease in cash flows from operations in the year of 2012 while reported

income is decreased significantly.

From the above information we can see that although reported income

has been decreased by 22.05% in the year 2012 cash flows from operations increased

by 74.19% in that year. Cash flows from operations increased because payments

for cost and expenses decreased significantly in that year but still reported

income is showing a negative growth rate.

Estimating Earning Quality of RAK CERAMICS Bangladesh

Limited :Earnings

management is predominantly a function of manipulating accruals, so it is

intuitive to use the magnitude of accruals as a proxy for earnings quality: the

higher the total accruals as a percentage of assets, the greater the likelihood

that earnings quality is low.

There are two approaches for measuring earnings quality-

1) Balance Sheet Approach: Formula = (NOAt

– NOAt-1)/{(NOAt + NOAt-1)/2}

2) Statement of Cash Flow Approach: Formula = {NIt–

(CFOt + CFIt)}/ )/{(NOAt + NOAt-1)/2}

Decision Rule: A high ratio indicates that the companies accrual basis

earnings has a high aggregate accruals component (more management discretion),

which implies low earning quality and vice versa.

Decision (Individual Evaluation):

Using both balance-sheet-based accruals ratio and cash flow

statement based accrual ratios we can conclude that RAK Ceramics Bangladesh

Limited has improved earnings quality from 2010 to 2012.

Analysis of Cash

Flow Statement :

FCF and OCF through graph :

In the following graph of

OCF we can see that OCF is higher in 2010but in 2011 it falls in a significant

amount due to the expansion of the firm in a subsidiary operation and also

due to increase their sale and overall profit.

Figure

: Operating cash flow.

In the following graph of FCF, we see that FCF

is is increasing all of the year of 2010, 2011 and 2012.

Figure

: Free cash flow.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Classification of RAK

CERAMICS BANGLADESH Limited in terms of OCF & FCF:

There are four types of decision that we can take:

OCF

|

FCF

|

Category

|

Positive (+)

|

Negative (-)

|

Growth Company

|

Positive (+)

|

Positive (+)

|

Cash Cow

|

Negative (-)

|

Positive (+)

|

Disinvest/Quit

|

Negative (-) > FCF

Negative (-) <FCF

|

Negative (-)

|

1)Disinvest/Quit

2) BMRE

|

As both Free cash Flow and Operating Cash Flow are positive for RAK

Ceramics Bangladesh Limited for every

year from 20010 to 2012 so the firm can be classified as a cash cow.

Analysis of Cash Flow Trend:

After analyzing the cash flow statement of RAK Ceramics Bangladesh Limited

it is found that although net cash inflows occurred from operating activities

year after year, net cash outflow occurred in investment activities from 2010

to 2012 and in financing activities from 2011 to 2012 for the company.

Cash Flow Trends:

v For analyzing cash flow trend the following

graphs are used-

Figure 01: Net Cash Inflow from

Operating Activities.

Explanation: The above figure

indicates that net cash inflows from operating activities decreased sharply in

the year of 2011. The reason identified is that cash payments for cost and

expenses increased significantly in that year. And then it started increasing

and continued to increase up to 2012.

The

following figure

no.02representsNet Cash Inflow from

Investment Activities :

Figure 02: Net Cash Inflow from Investment Activities.

Explanation: The above figure

indicates that net cash outflows from investment activities increased sharply

from the year of 2011. The reason identified is that cash investment in long

term asset is increased sharply from the year of 2011.

v The following figure

represents the cash outflow from financing activities :

Figure 03: Net Cash Inflow from Investment Activities.

Explanation: The above figure

indicates that net cash outflows from financing activities is increased from

2011 but in the year of 2010 there is cash inflow from financing activities.

Analysis of the performance of the Company

Ratios . . .

Du-pont Analysis

Year

|

O. Profit Margin

|

Total Asset Turnover

|

Interest Burden

|

After tax Retention rate

|

Financial Leverage

|

ROE

|

2012-13

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.10715

|

2013-14

|

0.231163737

|

0.566029405

|

0.96544092

|

0.6285

|

1.493380173

|

0.118566

|

2014-15

|

0.255994241

|

0.542538401

|

0.966350558

|

0.6285

|

1.533108031

|

0.129322

|

2015-16

|

0.283496813

|

0.516760449

|

0.963074422

|

0.66339878

|

1.572867181

|

0.147219

|

2016-17

|

0.313959723

|

0.503259403

|

0.959960378

|

0.695072586

|

1.640742022

|

0.172977

|

Sensitivity

of ROE in respect to operating profit margin-

Year

|

O. Profit Margin

|

Total Asset Turnover

|

Interest Burden

|

After tax Retention rate

|

Financial Leverage

|

ROE

|

% Change in ROE

|

2012-13

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.107150245

|

-

|

2013-14

|

0.231163737

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.118657842

|

0.107396839

|

2014-15

|

0.255994241

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.131403501

|

0.107415221

|

2015-16

|

0.283496813

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.145520749

|

0.107434339

|

2016-17

|

0.313959723

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.161157558

|

0.107454153

|

MEAN=0.107425138

SD=2.46692E-05

CV=0.000229641

|

|

Sensitivity of ROE in respect to Total Asset Turnover-

Year

|

O. Profit Margin

|

Total Asset Turnover

|

Interest Burden

|

After tax Retention rate

|

Financial Leverage

|

ROE

|

% Change in ROE

|

2012-13

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.107150245

|

-

|

2013-14

|

0.208745166

|

0.566029405

|

0.952951999

|

0.628500001

|

1.45632672

|

0.103060097

|

-0.03817208

|

2014-15

|

0.208745166

|

0.542538401

|

0.952951999

|

0.628500001

|

1.45632672

|

0.09878296

|

-0.041501385

|

2015-16

|

0.208745166

|

0.516760449

|

0.952951999

|

0.628500001

|

1.45632672

|

0.094089426

|

-0.047513599

|

2016-17

|

0.208745166

|

0.503259403

|

0.952951999

|

0.628500001

|

1.45632672

|

0.091631216

|

-0.026126314

|

MEAN=-0.038328344

SD=0.009006498

CV=-0.234982712

|

|

Sensitivity of ROE in

respect to Interest Burden-

Year

|

O. Profit Margin

|

Total Asset Turnover

|

Interest Burden

|

After tax Retention rate

|

Financial Leverage

|

ROE

|

% Change in ROE

|

2012-13

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.107150245

|

-

|

2013-14

|

0.208745166

|

0.588493423

|

0.96544092

|

0.628500001

|

1.45632672

|

0.108554503

|

0.013105509

|

2014-15

|

0.208745166

|

0.588493423

|

0.966350558

|

0.628500001

|

1.45632672

|

0.108656783

|

0.0009422

|

2015-16

|

0.208745166

|

0.588493423

|

0.963074422

|

0.628500001

|

1.45632672

|

0.108288413

|

-0.003390215

|

2016-17

|

0.208745166

|

0.588493423

|

0.959960378

|

0.628500001

|

1.45632672

|

0.107938269

|

-0.003233441

|

MEAN=0.001856013

SD=0.007763411

CV=4.182842526

Sensitivity of ROE

in respect to Financial Leverage-

Year

|

O. Profit Margin

|

Total Asset Turnover

|

Interest Burden

|

After tax Retention rate

|

Financial Leverage

|

ROE

|

% Change in ROE

|

2012-13

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.45632672

|

0.107150245

|

-

|

2013-14

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.493380173

|

0.109876478

|

0.025443091

|

2014-15

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.533108031

|

0.112799483

|

0.026602642

|

2015-16

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.572867181

|

0.115724789

|

0.025933691

|

2016-17

|

0.208745166

|

0.588493423

|

0.952951999

|

0.628500001

|

1.640742022

|

0.120718728

|

0.043153574

|

MEAN=0.03028325

SD=0.008593368

CV=0.283766382

|

|

DECISION: As CV is higher in case of interest burden, so, ROE is more

sensitive in case of interest burden.

v

Analysis of Sustainable Growth :

Computation of SG :

Computation Between Actual and Sustainable Growth :

The following graphs shows the

actual and sustainable growth comparison of the firm –

Explanation&

Suggestions:

The sustainability growth of RAK Ceramics Bangladesh Limited’s

is lower in 2011 and is higher in 2010 and 2012 than its AG which is a good

sign. It means that the company has the potential of going up growth. In these

cases, management's principal objective is finding productive uses for the cash

flows that exist in excess of their needs. Options available to business owners

and executives in such cases include returning the money to shareholders

through increased dividends or common stock repurchases, reducing the firm's

debt load, or increasing possession of lower earning liquid assets. These

actions serve to decrease the sustainable growth rate. Alternatively, these

firms can attempt to enhance their actual growth rates.

Estimation of Value Addition:

For estimating value addition at first intrinsic value of shares for

RAK Ceramics Bangladesh Ltd and no-growth value is calculated for every year

and then by subtracting no-growth value from intrinsic value present value of

growth opportunity (PVGO) is calculated which is the indicator for value

addition or subtraction.

Here,

Intrinsic value = D1/ (k-g) &

G = ROE*b

No-growth value = E1/ k

PVGO = Intrinsic Value – No-growth value

Explanation of the results:

From the above table we can see

that PVGO is positive and higher for the 2010 & 2011 and in 2012 it is

lower than previous year but positive. These positive growth opportunities

indicate that the growth opportunity actually increases the stock price.

v

Measuring DOL & DFL :

Degree of Financial leverage :

The degree of

financial leverage (DFL) is the leverage ratio that sums up the effect

of an amount of financial leverage on the earning per share of a company. The degree of financial leverage or DFL makes use of fixed

cost to provide finance to the firm and also includes the expenses before

interest and taxes. If the Degree of Financial Leverage is high, the Earnings

Per Share or EPS would be more unpredictable while all other factors would

remain the same.

The

degree of financial leverage or DFL helps in calculating the comparative change

in net income caused by a change in the capital structure of business.This

ratio also helps in determining the suitable financial leverage which is to be

used to achieve the business goal. The higher the leverage of the company, the

more risk it has, and a business should try and balance it as leverage is

similar to having a debt.

ü

From the above discussion we can say

that the DFL of the firm is decreasingslightly year after year but remain

positive throughout the year. That indicates that financial position of the

firm is not good. As the degree of financial leverage is positive so the

earning per share would be more unpredictable for the shareholders of the firm.

ü

Moreover higher the leverage ratio

of the firm, the more risk is in the firm. As leverage ratio of the firm is

positive so the firm need to balance its debt for better financial position.

ü

On the other hand the ratio also

helps the investor to decide which firm to invest in lower risk, with high

profitability. As the ratio is on the side of the firm and bears a bad

indication of higherrisk , so customer may not decide to invest in the firm. So

the firm should try to control the DFL.

Degree of Operating leverage:

The Degree of Operating Leverage (DOL) is the

leverage ratio that sums up the effect of an amount of operating leverage on

the company’s earnings before interests and taxes (EBIT). Operating Leverage

takes into account the proportion of fixed costs to variable costs in the

operations of a business. If the degree of operating leverage is high, it means

that the earnings

before interest and taxes

would be unpredictable for the company, even if all the other factors remain

the same.

A

business would benefit if it can estimate the Degree of Operating Leverage or

DOL. The impact of the leverage on the percentage of sales can be quite

striking if not taken seriously; therefore it is really important to minimize

these risks of the business.

ü

From the above table we see that the degree of

operating leverage of the firm was significantly higher in 2010 and 2011. That

indicates the earning before interest and taxes would be unpredictable even if

the all the others factors remain constant.

ü

On the other hand as

operating leverage is high a small percentage change in sales can increase the

net operating income. For this reason Since

the Degree of Operating Leverage or DOL helps in determining how the change in

sales volume would affect the profits of the company, it is important to

ascertain the value of degree of operating leverage in order to minimize the

losses to the company.

ü

When there is a higher degree of operating

leverage or DOL then the firm should try and balance the operating leverage to

balance with the financial leverage in order to provide with profits to the

company.

v

Comments on Disclosure Practice :

Mandatory Disclosure practices by RAK Ceramics

Bangladesh Limited :

I)

According

to ICAB manual typical annual report must include the followings-

ü Accounting policies;

ü Balance sheet

ü Cash flow statement

ü Profit and loss account

ü Notes to the financial statements

ü Chairpersons statement

ü Directors' Report

ü Operating and financial review

ü Other features Auditors report.

Ø RAK Ceramics Bangladesh Limited

provided a complete set of financial statements in their annual report which

include a statement of financial position, a statement of comprehensive income,

a statement of changes in equity, a statement of cash flows and notes for the

period according to the BAS 1(10).

In

addition annual reports should also disclose the following according to BAS-1:

II)

According

to BAS an entity should disclose the following information prominently-

a) The name of the reporting entity or

other means of identification, and any change in that information from the end

of the preceding reporting period;

b) Whether the financial statements are

of an individual entity or a group of entities;

c) The date of the end of the reporting

period or the period covered by the state of financial statements or noted;

d) The presentation currency; as

defined in BAS 21.

Ø The name of the reporting entity and

other means of identification are followed by RAK Ceramics Bangladesh Limited.

Ø It is also clear from the annual

report that the company is an individual entity. The dates of the end of the

reporting period are covered by the set of the financial statements or notes.

Sample is given in the following page-

RAK CERAMICS

(BANGLADESH) LTD.

Consolidated

Statement of Financial Position

as at 31 December 2012

|

RAK CERAMICS

(BANGLADESH) LTD.

Notes

to the Consolidated Financial Statements

As at and for the year

ended 31 December 2012.

|

v It is also disclosed in the annual

report of RAK Ceramics Bangladesh Ltd. that foreign currency transactions are

recorded at the applicable rates of exchange ruling at the transaction

date.

III)

The

company follows the BAS-1 (54) in completing financial position statement. But

some of the elements are absent.

IV)

According

to BAS-1 (97) When items of income or expenses are material; an entity shall

disclose their nature and amount separately.

Ø Items of income or expense are shown

separately both in the statements and notes by RAK Ceramics Bangladesh Limited.

V)

According

to BAS-1 (98) circumstances that would give rise to the separate disclosure of

items of income and expense include-

a) Write downs of inventories to net

realizable value or of property, plant and equipment to recoverable amount, as

well as reversals of such write-downs.

Ø The write down of inventory by RAK

Ceramics Bangladesh Limited-

|

b)Disposals of items in property, plant and equipment.

Ø Such disposals of RAK Ceramics

Bangladesh Limited are as follows-

Property, plant and equipment are

stated at their cost (Fair value for Building & other construction) less

accumulated depreciation in accordance with IAS 16 as adopted by ICAB as BAS 16

"Property, Plant and Equipment”. Cost represents cost of acquisition or

construction and capitalization of pre-production expenditure including

interest during construction periods. No depreciation is charged on land and

land development. Full year’s depreciation has been charged on additions

irrespective of date when the related assets are put into use. Depreciation on all

other fixed assets is computed using the straight line method in amounts

sufficient to write off depreciable assets over their estimated useful economic

lives.

VI)

According

to BAS an entity shall present statement a statement of changes in equity

showing in the statement:

a) Total comprehensive income for the

period, showing separately the total amounts attributable to owners of the

parent and to non controlling interest;

b) For each component of equity, a

reconciliation between the carrying amount at the beginning and the end of the

period, separately disclosing changes resulting from-

i)

Profit

or loss;

ii)

Each

item of other comprehensive income

iii)

Transactions

with owners in their capacity as owners, showing separately contributions by

and distributions to owners and changes in ownership interests in subsidiaries

that do not result in loss of control.

RAK Ceramics Bangladesh Limited has

followed the above rules of BAS-1 (106).

VII)

According

to BAS-1 (117) an entity shall disclose in the summary of significant accounting

policies:

a) The measurement basis (or bases)

used in preparing the financial statement, and

b) The other accounting policies used

that are relevant to an understanding of the financial statements.

Ø It is mentioned in the annual reports

of RAK Ceramics Bangladesh Limited that the company followed IAS, BAS, IFRS and

BFRS in preparation of financial statements.

Voluntary

disclosure practices of RAK ceramics ltd-

(I) Description about the products the

company manufactures;

(II) The breakdown of shareholding as follows-

Sl. No.

|

Shareholder's Group

|

No.

of Shares

Held

|

%

of Total

Shares

|

o.

of

Shareholders

|

1.

|

Sponsors &

Directors :

I. Local (Individual + Corp. Body)

II. Govt. of Bangladesh

III. Foreign

(Individual + Corp. Body)

|

18,556,374

N/A

201,578,626

|

6.67

N/A

72.41

|

1

N/A

8

|

2.

|

Associated

Companies

|

N/A

|

N/A

|

N/A

|

3.

|

Govt. of

Bangladesh

|

N/A

|

N/A

|

N/A

|

4.

|

Corporate Bodies

I. Local (other than in sl no. 1)

II. Foreign

(other than in sl. no. 1)

|

27,232,564

500

|

9.78

0.00

|

490

1

|

5.

|

General Investors

I. Local Individual

II. Non Resident Bangladeshis (NRBs)

III.Foreign

Individual

|

30,293,766

727,105

N/A

|

10.88

0.26

N/A

|

58,617

2,130

N/A

|

6.

|

Total

|

278,388,935

|

100.00

|

61,247

|

Choice of

Accounting Policies by RAK Ceramics Bangladesh Limited-

Some crucial accounting policies by RAK

Ceramics Bangladesh Limited are discussed below-

1) Recognition

of Income:

According to BAS-18 ‘Revenue’, Vat as included in sales price and collected on

behalf of customers is not considered as ‘Revenue’.

2) Property,

Plant and Equipment:

these are initially stated at cost of acquisition and subsequently stated at

cost less accumulated depreciation in accordance with BAS 16. Any kind of

repair and maintenance is charged off as revenue expenditure in the period when

it is incurred. But if it is clearly demonstrated that the expenditure has

resulted in an increase in future economic benefit expected to be obtained from

the use of fixed assets, then the expenditure is capitalized as an additional

cost of assets.

3)

Depreciation:Items

of property, plant and equipment are depreciated on a straight-

4)

line basis in profit or loss over the estimated useful lives of each

component. Capital work-in-progress and land are not depreciated. Depreciation

on addition to fixed assets is charged from the day of their acquisition and

charging of depreciation on property, plant and equipment ceases from the day

on which the deletion thereof takes place. Depreciation continues to be charged

on each item of property, plant and equipment until written down value of such

fixed asset is reduced to Taka one.

4)R & D Expenses: Development

costs are expensed when incurred instead of recognizing as an asset due to the

uncertainty of the related future economic benefit.

5) Advertising

and Promotional Expenses: All costs associated with advertising and promoting

products are expensed in the year incurred.

6)

Inventories:Inventories

on hand are valued at the lower of cost and net realisable value. For raw

materials and consumable spare parts cost is determined on a weighted average

cost basis. Work-in-process is stated at cost to complete of respective

product. Cost comprises cost of raw materials, wages and other overheads up to

the stage of completion. Finished products are stated at lower of cost and net

realisable value. Net realisable value is the estimated selling price in the

ordinary course of business less the estimated costs necessary to make the

sale. Raw materials in transit are valued at cost.

7)

Lease:

Leases for which the Company assumes substantially all of the risks and rewards

of ownership are classified as finance leases. On initial recognition, the

leased asset is measured at an amount equal to the lower of its fair value and

the present value of minimum lease payments. Subsequent to initial recognition,

the asset is accounted for in accordance with the accounting policy applicable

to that asset.

8) Taxes :

Current tax is the expected tax

payable on the taxable income for the year, using tax rates enacted or

substantially enacted at the reporting date, and any adjustment to tax payable

in respect of previous year. Provisions for corporate income tax is made

following the rate applicable for a publicly-traded company.

Deferred

tax has been recognised in accordance with Bangladesh Accounting Standard (BAS)

12. Deferred tax is provided using the liability method fortemporary

differences between the carrying amount of assets and liabilities for fi

nancial reporting purposes and the amount used for taxation purpose.Deferred

tax is determined at the effective income tax rate prevailing at the reporting

date.

Off Balance Sheet Items for RAK Ceramics Bangladesh

Limited-

The

only off balance sheet item for the company is Leased asset.

Economic Characteristics

& Strategies

|

Economic characteristics of a business can be easily

identified and evaluated using Structure Conduct Performance Analysis or SCP

Analysis.

The Structure-Conduct-Performance (S-C-P) paradigm of

strategy assumes market structure would determine firm conduct which would

determine performance. This is a paradigm that is foundational to industrial

organization economics, consistent with the positional view of strategy, as

opposed to the resource-based view of strategy.

This

model can be used to justify consolidation in the industry. If Structure drives

Performance, one way to improve performance is to create a more attractive

industry Structure. This analysis is similar to the competitive intensity

dimension of Porters 5 forces analysis.

The

usefulness of this model is diminished when industry boundaries are blurred and

primary threats are coming from outside the industry.

S-C-P

analysis framework:

Highlight in Structure

:

- Industry concentration – from monopoly to perfect competition?

(Ceramics

industry is not perfectly competitive in our country).

- Market share pattern – is there a dominant leader?

(

RAK ceramics has high market sharein this industry share relative to others and

it is a domonent leader firm).

- What is the Minimum Efficient Scale?

(

As the market pattern is competitive so a small change in price specially based

on better quality with newer design is efficient scale in this industry.)

- Ownership of major companies (if they are listed/family/state-owned)

( Most of

the companies in this industry are listed in DSE. Owners are sponsors

directors, general investors, non-resident Bangladeshi and corporate bodies.)

Highligh inConduct :

- Where do they compete? Prices? Service? Advertising investment? War for Talent? Product innovation?

(In Ceramic

industry the firms compete both on prices, service, and product innovation. To

grab the market share with reasonable prices and with cost leadership they

compete with each other on basis innovating new product with new design and

high quality.)

- Is the conduct stable, or is it erratic, linked to the industry cycle?

( Ceramics

industry conduct specially the production, marketing above all customer

satisfaction level is stable on the product quality.)

- Do player try to differentiate, or follow “me-too” strategy?

( As there

is competition to grab the customers for this the players on the field always

try to differentiate themselves with newer quality type ceramics products with

higher quality superior to their competitors.

- Do competitors try to grow the pie (“good competitors”), or fight to enlarge their share (“bad competitors”)?

( Actually

the competitors always try to enlarge their market share as a result they

engage in bad competition. But ceramics companies try to be good competitors

and at the same time try to grab market share).

Highlight in Performance:

- Long term Total Shareholder Returns (TSR)?

(

On the growing stage the total shareholders return is simply lower than any

other industry, because of customer acceptance with the satisfaction after they

use.)

- Return on Capital Employed? (ROCE)

(

ROCE is medium in this industry).

- Economic Profit?

80/20

rule – if we calculate this for the largest companies, our estimate for the industry

will be accurate. If we can’t get the data for some private companies or

divisions, then we will identify the best comparable company and assume the

same profitability and quantify, average over several years to remove the

industry cycle effect.

Policy Implications and

Conclusions

|

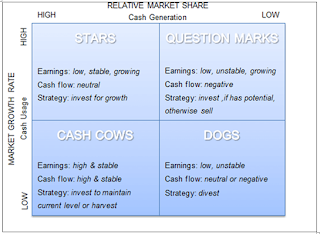

Classifying RAK Ceramics Bangladesh Limited using

Boston Consultant Matrix-

The BCG Matrix was developed by Bruce Henderson of the

Boston Consulting Group, a strategic management consulting firm, in the early

1970s, to analyze the performance of products. According to this technique,

business or products are classified as low or high performers depending upon

their market growth rate and relative market share. It is a two-by-two graph,

with market growth shown on the vertical axis and market share charted on the

horizontal axis.

The matrix

places products or business into four categories based on their market share

and market growth. The categories are-

v Dogs:Low

Market Share and Low Market Growth. They often don't make much profit, but they don't need

much investment either. Much of the time, the company may need to offer a price

discount to sell Dog products.

v Cash

Cows:High Market Share and Low Market Growth. These businesses or products are

well established. They're likely to be popular with customers, which makes it

easier for the company to exploit new opportunities. However, the firm should

avoid spending too much effort on these, because the market is only growing

slowly, and opportunities are likely to be limited.

v Stars:High

Market Share and High Market Growth. Businesses and products in this quadrant are seeing rapid

growth. There should be some good opportunities here, and the firm should work

hard to realize them.

v Question

Marks (Problem Children):Low Market Share and High Market

Growth. These

are the opportunities that no one knows how to handle. They aren't generating

much revenue right now, because the company doesn't have a large market share.

But they're in high-growth markets, so they could become Stars or even Cash

Cows if the firm can build market share. However, if the firm cannot increase

market share, Question Marks could absorb a lot of effort with little return.

Application of BCG matrix in perspective of RAK Ceramics Limited :

From the above discussion it can

be decided that RAK Ceramics Bangladesh Ltd is a cash cow firm. Because from my analysis of the corresponding market

share of this firm is almost 60%, while its other competitors market share is

very small amount of each of the firm.On the other hand it is also clear that

its growing rate is higher than its competitor. So, the firm has the

possibility to be star. On the other hand when the firm lost his growth rate it

will turn into as a dog, where it should be shut down.

VRIN MODEL

Applying Barney's (1991) VRIN framework can determine if a

resource is a source of sustainable competitive advantage. The resource-based

view (RBV) is a way of viewing the firm and in turn of approaching strategy.

Fundamentally, this theory formulates the firm to be a bundle of resources. It

is these resources and the way that they are combined, which make firms

different from one another. It is considered as taking an inside-out approach

while analyzing the firm. This means

that the starting point of the analysis is the internal environment of the

organization.

The VRIN characteristics :

The important features for a resource to be

strategically important are as below

§ Valuable - When resources are able to bring value to the firm they can

be a source of competitive advantage.

§ Rare - Resources have to deliver a unique strategy to provide a

competitive advantage to the firm as compared to the competing firms. Consider

the case where a resource is valuable but it exists in the competitor firms as

well. Such a resource is not rare to provide competitive advantage

§ Inimitable - Resources can be sources of sustained competitive advantage

if competing firms cannot obtain them. Consider the case where a resource is

valuable and rare but the competing organizations can copy them easily. Such

resources also cannot be sources of competitive advantage

- Non-substitutable - Resources should not be able to be replaced by any other strategically equivalent valuable resources. If two resources can be utilized separately to implement the same strategy then.

Competency

|

Valuable

|

Rare

|

Inimitable

|

Non-

Sub

|

Conclusion

|

Technology and instrument

|

Yes

|

No

|

No

|

Yes

|

Comp. Parity

|

Innovation of new product

|

Yes

|

Yes

|

Yes

|

No

|

Temp. comp. adv.

|

Specializing in producing high

quality ceramics products

|

Yes

|

Yes

|

No

|

No

|

Sustainable comp. adv.

|

Identify key

competencies and Constructing a VRIN Table:

Application of VRIN model in RAK ceramics ltd :

As RAK

Ceramics Ltd valuable and non substitute instrument and it is able to innovate

new product with new dimension and with higher quality and can capture the

market share with high value brand which is not so easily inimitable by other

ceramic industry and also it has achieved specialization in producing higher

quality new products than any other firms. So, RAK ceramics has sustainable

competitive advantage.

COURCES OF ACTIONS FIRMS NEEED TO TAKE AND THE POLICY

SHOULD BE IMPLEMENTED:

From the

above analysis we conclude that RAK Ceramics has high growth prospects as its

sustainability growth is higher and its growth opportunity is positive. So, to

keep up its market opportunity and to sustain in long run, the RAK Ceramics

should try to continue to produce higher quality, effectively usable, new

dimensional innovative products and it has the ability to produce such types of

products. It should keep its high value brand sustainable in long run. As its

operating and free cash flow is positive, so it is in cash cow position. So the

firm should properly use and invest the fund in more productive sectors. Beside

these, the firm’s degree of operating leverage and financial leverage. So it

should be more careful in taking about its financing. As its interest burden is

more sensitive to its ROE, so the firm should be more conscious about its debt

financing. The firm should be more careful about its contingent liabilities.

Very nice post!

ReplyDeleteIt was exceptionally helpful! I am heartily impressed by your blog and learned more from your article, thank you so much for sharing with us. Top Ceramic Brand in Bangladesh keep doing awesome You will get well-informed data about it here.